BTC Price Prediction: Analyzing Investment Potential Amid Technical and Fundamental Strength

#BTC

- Technical Strength: BTC trading above 20-day moving average with approaching upper Bollinger Band indicates bullish momentum

- Institutional Demand: Record ETF inflows and growing institutional participation provide substantial market support

- Network Fundamentals: Unprecedented hashrate levels above 1 zetahash/second demonstrate robust network security and health

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

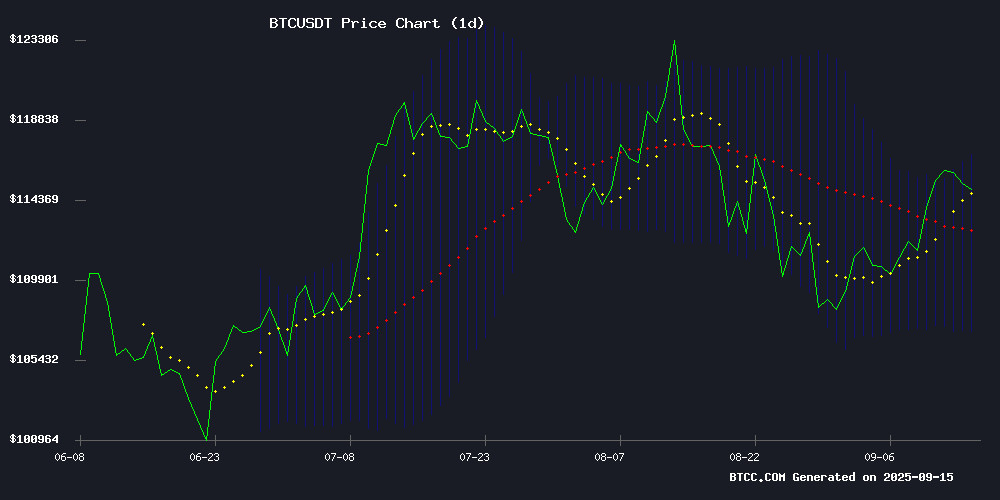

BTC is currently trading at $115,731, positioned above its 20-day moving average of $112,008, indicating underlying bullish momentum. The MACD reading of -2,216.79 suggests some near-term pressure, though the asset remains within the upper Bollinger Band range of $117,034. According to BTCC financial analyst William, 'The price holding above the 20-day MA while approaching the upper Bollinger Band typically signals continued strength, though traders should monitor for potential resistance at the $117,000 level.'

Market Sentiment: Institutional Inflows and Network Strength Support BTC Outlook

Recent news highlights record Bitcoin inflows and growing institutional demand, with US spot Bitcoin ETFs recording $552.8 million in inflows during the price recovery. The Bitcoin hashrate surpassing 1 zetahash per second represents a new security benchmark, reinforcing network robustness. BTCC financial analyst William notes, 'While short-term resistance near all-time highs and Fed decisions may cause volatility, the fundamental backdrop of institutional adoption and network security provides strong long-term support.'

Factors Influencing BTC's Price

Bitcoin Inflows Surge Past 15-Year Record as Institutional Demand Grows

Bitcoin's on-chain capital inflows from 2024 to 2025 have eclipsed the cumulative total from 2009 to 2024 by nearly $200 billion, marking an unprecedented acceleration in institutional adoption. CryptoQuant CEO Ki Young Ju notes that $625 billion in realized funds entered the Bitcoin ecosystem in just 1.5 years, dwarfing the $435 billion accumulated over the prior 15 years.

The surge coincides with Wall Street's embrace of spot Bitcoin ETFs and corporate treasury allocations. BlackRock's IBIT and Fidelity's FBTC now rank among history's fastest-growing ETFs, while MicroStrategy continues aggressively converting cash reserves into BTC. This institutional wave has transformed Bitcoin's liquidity profile - the cryptocurrency now trades with bid-ask spreads rivaling major tech stocks during peak hours.

Crypto Firms Figure and Gemini Drive $1.2 Billion IPO Resurgence

Figure Technology and Gemini Space Station ignited the U.S. IPO market with blockbuster debuts, signaling renewed institutional confidence in crypto-native businesses. The blockchain-based lender Figure surged 44% on its Nasdaq opening, achieving a $7.6 billion valuation after pricing above expectations at $25 per share. Trading volatility saw shares peak at $38 before settling at $32.50 by week's end.

Gemini's 32% first-day pop on the NYSE underscored pent-up demand for regulated crypto exposure, with the Winklevoss twins' exchange commanding a $4.4 billion market cap. The dual success marks the largest concentrated wave of digital asset IPOs since the 2022 market downturn, with both firms leveraging blockchain infrastructure to disrupt traditional finance sectors.

Bitcoin Faces Resistance Near All-Time Highs as Fed Rate Decision Looms

Bitcoin's price hovers around $116,000, showing reluctance to breach record levels ahead of the Federal Reserve's September 17 FOMC meeting. Despite a 4% weekly gain, the cryptocurrency's hesitation fuels speculation about fading momentum as traders await clarity on potential rate cuts.

Noted economist and crypto skeptic Peter Schiff asserts Bitcoin is "topping out," highlighting its 15% underperformance against gold since 2021. "Even traditional equity markets like the S&P 500 and Nasdaq are hitting records while Bitcoin struggles," Schiff observed, suggesting investors are flocking to precious metals as safer havens.

The anticipated 25-basis-point Fed rate cut—with Goldman Sachs projecting three consecutive reductions through December—introduces market uncertainty. While historically supportive of risk assets, some analysts warn short-term bearish effects may emerge as traders digest the implications of monetary easing amid persistent inflation.

Hayes Urges Patience Amid Crypto Market Slump

Arthur Hayes, co-founder of BitMEX, offers a contrarian perspective on the current crypto market stagnation. Rather than joining the chorus of pessimism, Hayes points to global monetary policy as the overlooked driver of cryptocurrency valuations. "Governments will continue to print money," he asserts, framing this macroeconomic reality as fuel for an extended bull cycle that could persist through 2026.

His analysis challenges conventional market readings focused on short-term price action or halving cycles. The former BitMEX CEO emphasizes that unlimited fiat creation creates structural support for hard-capped assets like Bitcoin. This stance emerges during an interview with crypto entrepreneur Kyle Chassé, where Hayes dismissed crash predictions as myopic.

The commentary arrives as traders grapple with sideways price action across major cryptocurrencies. Hayes' thesis suggests investors are misdiagnosing the market by ignoring central bank balance sheet expansion. His view implies that crypto's fundamental value proposition—scarcity versus inflationary fiat—remains intact despite recent volatility.

Bitcoin-Gold Correlation Turns Negative Amid Market Shifts

Bitcoin's relationship with gold has taken a dramatic turn, with the 30-day correlation between the two assets plunging to -0.53, according to Glassnode data. This negative correlation indicates they are now moving in opposite directions—a stark departure from their historical behavior.

Gold, the traditional safe-haven asset, continues to attract investors during periods of economic uncertainty. Bitcoin, once viewed as purely speculative, has gained traction among both institutional and retail investors. The divergence suggests Bitcoin is increasingly being treated as a risk-on asset rather than a hedge against turmoil.

For traders and analysts, this shift has significant implications. Portfolio strategies, risk management frameworks, and trading algorithms may require recalibration. The -0.53 reading means when gold rises, Bitcoin tends to fall—and vice versa—creating new arbitrage opportunities and hedging possibilities.

The changing dynamic reflects evolving investor psychology. While gold remains the go-to asset during geopolitical crises or inflation spikes, Bitcoin's price action now mirrors tech stocks more than precious metals. This decoupling could redefine how both assets are used in diversified portfolios moving forward.

UK's Largest Bitcoin Holder Smarter Web Eyes FTSE 100 Entry Through Strategic Acquisitions

The Smarter Web Company, Britain's leading corporate Bitcoin treasury, is positioning itself for expansion by targeting distressed competitors. CEO Andrew Webley revealed plans to acquire struggling crypto firms at discounted valuations, a move that could significantly boost its 2,470 BTC holdings currently worth $275 million.

This aggressive accumulation strategy serves dual purposes: strengthening the company's dominance in digital asset reserves while paving its path to FTSE 100 inclusion. Webley acknowledges an inevitable rebranding to reflect this strategic pivot, though emphasizes careful execution.

The potential fire-sale acquisitions present both opportunity and risk. While bankrupt crypto firms' assets may come cheap, integrating them requires navigating complex operational and regulatory challenges. Smarter Web's approach mirrors MicroStrategy's playbook - leveraging market downturns to amass Bitcoin at favorable prices.

Bitcoin News: Key Developments This Weekend

Bitcoin miners are back in the spotlight as their holding behavior signals bullish sentiment. The 30-day moving average of miner-to-exchange flows has cooled to a short-term low, indicating reduced selling pressure. This suggests miners anticipate higher BTC prices in the coming weeks.

Japan's decision to slash crypto taxes from 55% to 20% could further fuel market optimism. The move, coming amid expectations of a Federal Reserve rate cut, may encourage greater investment in digital assets. Lower tax burdens typically increase retail participation and capital inflows.

Bitcoin Hashrate Surpasses 1 Zetahash per Second, Setting New Security Benchmark

Bitcoin's hashrate has achieved a historic milestone, exceeding 1 zetahash per second—equivalent to one sextillion computations every second. This unprecedented level of computational power underscores Bitcoin's growing security and resilience against attacks.

Dan Tapiero, a prominent macro investor and Bitcoin advocate, captured the sentiment of the moment: "How do people still not get it?" The network's hashrate, now at an all-time high, reflects the immense energy dedicated to securing the blockchain through Proof-of-Work.

Miners worldwide are deploying increasingly sophisticated hardware to compete for block rewards, driving both hashrate and difficulty to record levels. The scale is staggering: each second, more calculations are performed than there are stars in the galaxy or grains of sand on Earth.

US Spot Bitcoin ETFs Record $552.8M Inflows Amid Price Recovery

Institutional investors are returning to Bitcoin with conviction. U.S. spot Bitcoin ETFs saw $552.78 million in net inflows on Thursday, marking the fourth consecutive day of positive flows. This resurgence follows August's $751 million outflows—the third-worst month since these funds launched in January 2024.

BlackRock's IBIT led the charge with $366.2 million, while Fidelity's FBTC attracted $134.7 million. Bitwise, VanEck, Invesco, and Franklin Templeton products also contributed to the $1.7 billion four-day inflow streak. Bitcoin's price action tells the same story: the cryptocurrency traded above $115,000 Friday, up 4% weekly as it reclaimed key technical levels.

The ETF momentum signals growing institutional comfort with Bitcoin's volatility. Market observers note these flows act as a stabilizing force—a stark contrast to the wild swings typical of retail-dominated crypto markets.

Top Catalysts for the Crypto Market This Week

The crypto market, fresh off a rally that pushed total capitalization above $4 trillion, faces pivotal macroeconomic and sector-specific tests this week. All eyes turn to the Federal Reserve's September 16-17 meeting, where economists anticipate rate cuts following disappointing U.S. jobs data. Such monetary easing historically fuels risk assets—recall Bitcoin's pandemic-era surge during zero-rate policies—though traders now debate whether markets have overpriced this dovish pivot.

Meanwhile, the Altcoin Season Index's relentless climb signals growing speculative appetite beyond Bitcoin. This momentum faces immediate liquidity tests as multiple projects schedule major token unlocks, creating potential volatility. Notably, the market continues digesting Gemini's IPO announcement alongside institutional inflows that defy typical September sluggishness.

Arthur Hayes Advocates Long-Term Bitcoin Strategy Amid Market Comparisons

BitMEX co-founder Arthur Hayes dismissed short-term speculative fervor around Bitcoin in a recent YouTube discussion with Kyle Chasse. "If you thought you were buying Bitcoin and the next day you were buying a Lamborghini, you're probably getting liquidated," Hayes stated, emphasizing the cryptocurrency's multi-year growth cycles over dopamine-chasing trades.

Bitcoin currently trades at $115,400—below its August 2025 peak of $124,100—while traditional assets like gold ($3,674) and the S&P 500 (6,587) hit record highs. Hayes reframed the comparison: "Bitcoin is the best performing asset when you think about currency debasement ever." He noted the S&P 500 still hasn't recovered from 2008 when priced in gold, whereas Bitcoin's appreciation dwarfs both.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a compelling investment case. The price trading above the 20-day moving average combined with record institutional inflows and network security achievements creates a positive environment. However, investors should consider both opportunities and risks:

| Factor | Assessment | Impact |

|---|---|---|

| Price vs. 20-day MA | Above average ($115,731 vs $112,008) | Bullish |

| Institutional Inflows | Record ETF inflows ($552.8M) | Very Positive |

| Network Security | Hashrate >1 Zetahash/sec | Strong |

| Resistance Levels | Near all-time highs | Caution |

| Fed Policy Impact | Pending rate decision | Uncertain |

BTCC financial analyst William suggests, 'While short-term volatility may occur due to resistance levels and macroeconomic factors, the long-term fundamentals including institutional adoption and network security make BTC a solid investment for diversified portfolios.'